All i need to know about crypto trading

On 25 March 2014, the United States Internal Revenue Service (IRS) ruled that bitcoin will be treated as property for tax purposes. Therefore, virtual currencies are considered commodities subject to capital gains tax https://thumbstub.com/lincoln-casino-bonus-codes/.

Select cryptocurrency exchanges have offered to let the user choose between different presets of transaction fee values during the currency conversion. One of those exchanges, namely LiteBit, previously headquartered in the Netherlands, was forced to cease all operations on August 13th, 2023, “due to market changes and regulatory pressure”.

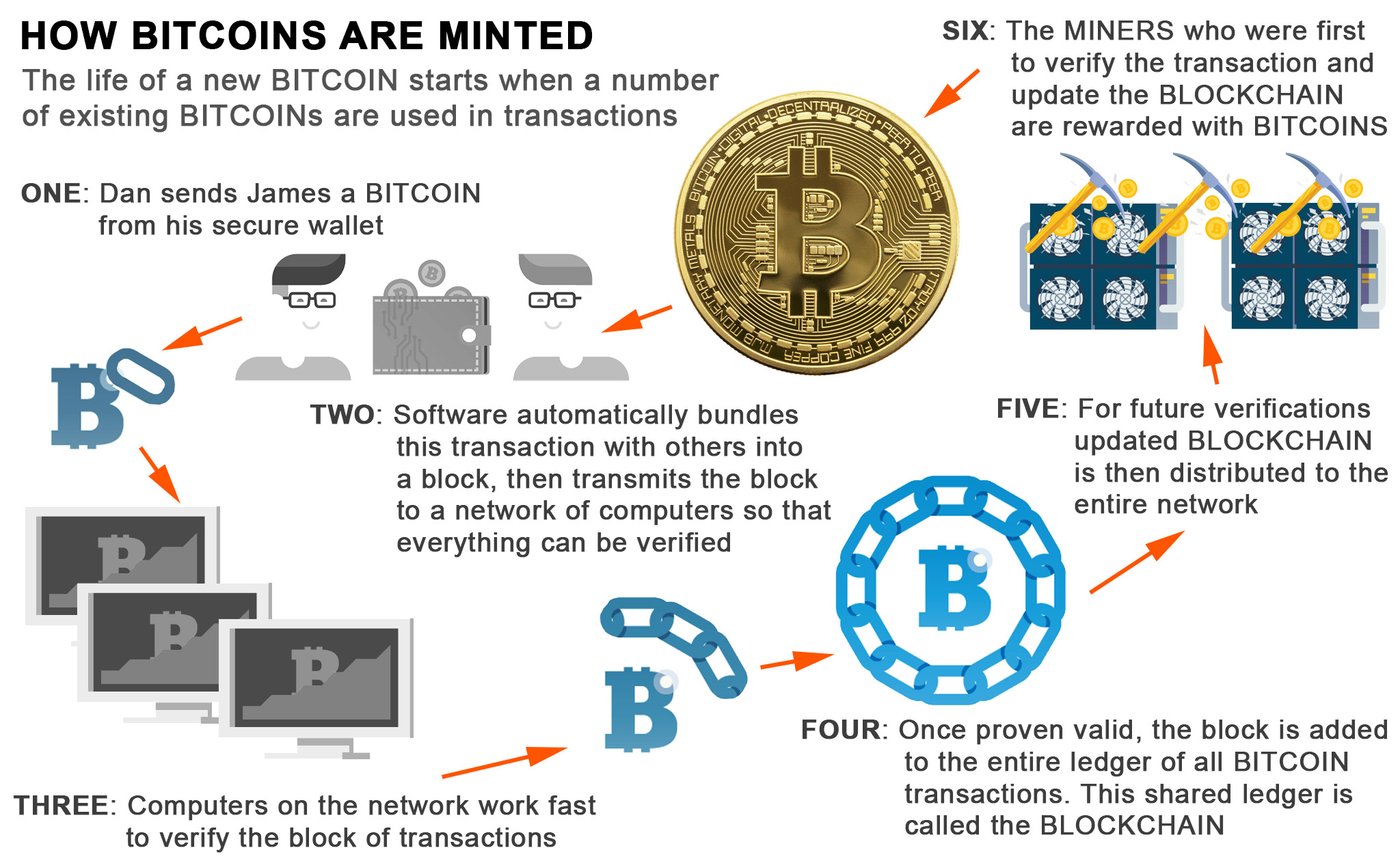

Within a proof-of-work system such as bitcoin, the safety, integrity, and balance of ledgers are maintained by a community of mutually distrustful parties referred to as miners. Miners use their computers to help validate and timestamp transactions, adding them to the ledger in accordance with a particular timestamping scheme. In a proof-of-stake blockchain, transactions are validated by holders of the associated cryptocurrency, sometimes grouped together in stake pools.

Transactions that occur through the use and exchange of these altcoins are independent from formal banking systems, and therefore can make tax evasion simpler for individuals. Since charting taxable income is based upon what a recipient reports to the revenue service, it becomes extremely difficult to account for transactions made using existing cryptocurrencies, a mode of exchange that is complex and difficult to track.

All about crypto trading

To start with cryptocurrency, you’ll need to choose a broker or crypto exchange. An exchange is an online platform where you can trade cryptocurrencies. Brokers use interfaces that interact with exchanges.

Cryptocurrencies are legal in the European Union. Derivatives and other products that use cryptocurrencies must qualify as “financial instruments.” In June 2023, the European Commission’s Markets in Crypto-Assets (MiCA) regulation went into effect. This law sets safeguards and establishes rules for companies or vendors providing financial services using cryptocurrencies.

HODLing is ideal for those who believe in the long-term potential of specific cryptocurrencies such as Bitcoin or Ethereum and are willing to weather short-term price fluctuations. While this strategy requires patience, it may provide substantial returns over time.

Cryptocurrency is a digital form of money that only exists online. It uses cryptography to secure transactions. Compared to fiat currencies, cryptocurrencies are not controlled by any bank or government. They operate completely on a decentralized system called blockchain. This is a public ledger that records every transaction.

Bullish and bearish trends can also exist within larger, opposing trends, depending on the time horizon. Generally, an uptrend results in higher highs and higher lows, while a downtrend results in lower highs and lower lows.

All about crypto mining

While the process seems relatively straightforward, you won’t be able to use a regular computer to mine cryptocurrencies since it’s not powerful enough. That means you’ll need to invest into proper mining equipment to start this process.

There are a few different methods when learning how to mine cryptocurrency, including cloud mining, CPU mining, GPU mining, and ASIC mining. No matter which method you choose, you should pick a reliable wallet to store your cryptocurrency.

At this point, the candidate block becomes a confirmed block, and all miners move on to mine the next block. Miners who couldn’t find a valid hash on time discard their candidate block as a new mining race starts.

Disclaimer: This content is presented to you on an “as is” basis for general information and educational purposes only, without representation or warranty of any kind. It should not be construed as financial, legal or other professional advice, nor is it intended to recommend the purchase of any specific product or service. You should seek your own advice from appropriate professional advisors. Where the article is contributed by a third party contributor, please note that those views expressed belong to the third party contributor, and do not necessarily reflect those of Binance Academy. Please read our full disclaimer here for further details. Digital asset prices can be volatile. The value of your investment may go down or up and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance Academy is not liable for any losses you may incur. This material should not be construed as financial, legal or other professional advice. For more information, see our Terms of Use and Risk Warning.

While the process seems relatively straightforward, you won’t be able to use a regular computer to mine cryptocurrencies since it’s not powerful enough. That means you’ll need to invest into proper mining equipment to start this process.

There are a few different methods when learning how to mine cryptocurrency, including cloud mining, CPU mining, GPU mining, and ASIC mining. No matter which method you choose, you should pick a reliable wallet to store your cryptocurrency.

What is crypto investment all about

Stablecoins such as tether tether , U.S. dollar coin, and DAI DAI were created to take advantage of the peer-to-peer electronic transfers introduced by bitcoin, but with faster settlement and less volatility. These digital currencies are disrupting the money-transfer industry and provide a payment option to the world’s unbanked population.

Enthusiasts called it a victory for crypto; however, crypto exchanges are regulated by the SEC, as are coin offerings or sales to institutional investors. So, crypto is legal in the U.S., but regulatory agencies are slowly gaining ground in the industry.

Whether or not cryptocurrency is a security is a bit of a gray area right now. To back up a little, generally, a “security” in finance is anything that represents a value and can be traded. Stocks are securities because they represent ownership in a public company. Bonds are securities because they represent a debt owed to the bondholder. And both of these securities can be traded on public markets.

For shorter-term crypto investors, there are other risks. Its prices tend to change rapidly, and while that means that many people have made money quickly by buying in at the right time, many others have lost money by doing so just before a crypto crash.

Despite these risks, cryptocurrencies have seen a significant price leap, with the total market capitalization rising to about $2.4 trillion. Despite the asset’s speculative nature, some have created substantial fortunes by taking on the risk of investing in early-stage cryptocurrencies.

No comment yet, add your voice below!